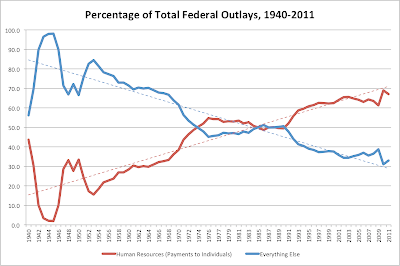

I feel like I'm beating a somewhat dead horse here--or perhaps stabbing it with an obsolete bayonet--but I'd like to reintroduce the chart that represents the single largest threat to our continued national existence. I posted a slightly different version of it here, but I've relabeled some curves and added some trend lines to make things a bit more specific:

This is straight from White House statistics. There are a lot of versions of this chart floating around, but most of them show payments to individuals, aka mandatory spending, aka entitlements, as a percentage of GDP. Those are plenty alarming, but I think this one makes the case a bit more persuasively.

The American public will only put up with a certain level of taxation, so revenues are going to be capped at some relatively constant amount of GDP. The real problem is what we spend those revenues on--what the outlays are.

This chart ought to scare the crap out of you. Note that the linear regression here is pretty tight and, well, it's linear. This shows payments to individuals rising at a pretty constant 0.77% per year. Now obviously, this can't go one forever, because it's impossible to exceed 100% of total outlays. But so far, there's very little sign of the curve going asymptotic.

What that means is that discretionary spending is being crowded out very rapidly. So when Obama talks about making education a priority, or rebuilding infrastructure, or investing in basic research, most of which are essential, he might as well be shooting the breeze with his buds from the Choom Gang. (Yes, double entendre intended.)

But he's right; we do need all that "investment". But he is so dead set on preserving the national entitlement culture that we simply can't do it. Until we realize that we can't pay everybody enough money to make their lives totally secure and anxiety-free, we're merely swapping a bit of comfort today for decades of misery in the not-too-distant future.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment